By Bob Livingston

Federal taxes were "due" and there's something you should know about all that money being disappeared from the system:

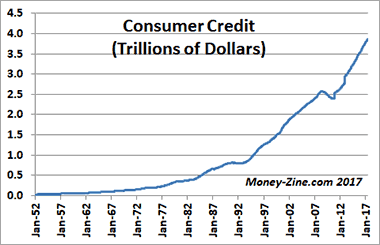

Cash is no longer king. Credit rules. Movement of money used to be important. Now it's the movement of debt. When the upward movement of debt slowed down in 2008 (you can see it in the small glitch in the chart below) the entire world's economy almost collapsed.  You will never know how close it came to total collapse because the truth can never be known, lest the public revolt at the fact that money does not exist anymore. Only credit exists.

This is why the government must keep interest rates low, mortgage rates low, must incentivize car loans, college loans, "Christmas" spending and credit card debt and increase sales tax revenues.

When consumers stop spending money they don't have — when debt slows — the "economy" falters.

Why target cash?

Cash is being abolished in favor of debt. Cash itself is a "note," or a debt from the federal government to you, as I have pointed out. That arrangement must be abolished. Yes, they want to track you through electronic transactions. But the goal of the powers that be is always to extract wealth from the people. If they can get their useful idiots and psychopaths in government to take directly from the people, it will have to print less money, thereby extending the life of the system that must fail, as all fiat systems have, and extending the theft.

How else do you think it's possible they could float something as ridiculous as negative interest rates — that banks can charge you, not pay you, to park your cash there — in Europe and other places, and investors would line up to do it? Because the investors know there will be less debt doing it that way. They lock in a lower loss than the credit system would otherwise afford them.

You might simply now say that "cashless is king." Visa recently offered a reward of $10,000 if stores would go cashless. And banks now use advertising images of young people, even children, and their ease with the newest technology to make anyone using cash feel like an old fuddy-duddy and an outcast.

"Why are users of physical cash being targeted ... by governments and banks? The simple answer is to dissuade us from using cash and to encourage us to use as little of it as is possible or to create a perception that if we do use cash, we're behaving like some outmoded throwbacks and the kids will look on us as — horror of horrors — in danger of becoming obsolete." -- Nakedcapitalism.com

What is cash? Ultimately, what exactly is physical cash? Nakedcapitalism.com also points out that "it has some unique and rather special characteristics. As a service, it is free at the point of use. When I pay you in cash, neither of us incur a fee for my settling my account with you by handing over notes or coins." The banksters can't have that. "People using money for free instead of incurring a 3.25 percent charge for using a credit card? Humbug!" They are goading us into abandoning the only money that has no settlement fee for using it, and which pays interest when you store it, in favor of taxable, fee-based debt that you owe interest on. How did no one see the switch from earning and saving to borrowing and spending? It happened gradually, over time, since December 1913 when the Federal Reserve was established. On the very first page of Henry Hazlitt's book Economics in One Lesson he writes: "While certain public policies would in the long run benefit everybody, other policies would benefit one group only at the expense of all other groups. The group that would benefit by such policies, having such a direct interest in them, will argue for them plausibly and persistently. It will hire the best buyable minds to devote their whole time to presenting its case. And it will finally either convince the general public that its case is sound, or so befuddle it that clear thinking on the subject becomes next to impossible." Thus, we've become befuddled and confused over what real money is, all according to the plan officially put into play a hundred years ago. Before that time, banks would lend money. After the Fed was created, banks were there to provide credit. Central banks don't deal in money, they deal in "financing conditions" and "liquidity." This does not include lending out cash — which one thinks of as the very thing a bank does. No, this means incestuously purchasing government or corporate bonds with newly minted public "credit," keeping in mind that notes and bonds are much nicer names for what they really are, which are "debt instruments." All controlled by the Federal Reserve. In an interview from 1994 on C-Span's show Booknotes, Milton Friedman explained why he was for ripping the heart out of this immoral system of debt serfdom and abolishing the Fed. "Look, the Federal Reserve started operation in 1914. It presided over a doubling of prices during WWI, it produced a major collapse in 1921 ... it undertook actions which led to a recession in 1929-30, and it converted that recession, by its actions, into the Great Depression ... Since that time, it presided over a doubling of prices during WWII, it financed the inflation of the 1970s... It's done far more harm than good." Where's the cash? Consider that in the United States, most of the money in our financial system is in stocks, derivatives, bonds, mortgages and digital bank deposits. The real physical cash in circulation — that is, stuff you can actually hold in your hands — adds up in total to less than 1 percent of all the money in our financial system. Here's another curious fact that may surprise you and illustrates just how far the war on cash has encroached into our financial life. Once upon a time, the U.S. printed denominations of $500, $1,000, $5,000, and even $10,000 notes. These large bills were no longer printed after 1945, and under the pretext of fighting the war on drugs, in 1969 the U.S. government eliminated all large denominations. The largest paper note now printed by the Treasury Department is the $100 bill. If anyone needed further proof that cash is disappearing, I point out that the world's largest printer of banknotes, after cutting production and firing employees, also sold its paper banknote business off to an investment fund. De La Rue produces banknotes for over 150 national currencies (including the British pound sterling, for example), more than any other company in the world, and will continue to produce polymer banknotes and passports, even though it just lost out on the job to continue to make the U.K.'s iconic blue passports. Are the money creators winning the war on untraceable, untaxable, user fee-free private cash? Not yet. India's war on cash has backfired. Economic growth has slowed, and the push to stop "criminals" has resulted in millions of jobs lost, and a loss pf privacy for Indians. Swedes, who also went all in on a cashless society, are now regretting their decision due to loss of privacy and vulnerability to hackers and thieves — the very bad actors moving away from cash was supposed to stop. There are more than enough reasons to take personal measures to retain a certain level of freedom in your financial affairs by converting a portion of your wealth into non-digital assets like gold and silver bullion coins and bars, jewelry, precious gems, art and antiques or other hard assets. Of these, gold and silver bullion requires the least amount of specialized knowledge. Of course, you'll have to provide storage and security for these hard asset valuables. You may want to consider offshore non-bank storage to get your goods as far from U.S. government hands as is legally permissible, both to protect privacy and to protect against seizure or even confiscation. Be sure to abide by all U.S. and international laws when considering offshore storage for your valuables. Bob Livingston Alerts in no way advocates illegal activities. You also want to do due diligence on the integrity of the storage institution you choose and the political stability of the country where they operate. I advocate holding gold and silver for future use, and if you go here, I'll give you my best advice on doing so, but for now, you should hold some cash money — enough to cover about three months of bills if possible. Buy with cash while you can, but be careful who you tell that you have it, and store it in a safe, preferably hidden away. I can't believe it, but some people still ask if they should put their assets in a bank safety deposit box. The answer is still a resounding "No." Banks are pseudo-governmental agencies and contents are subject to seizure. |

No comments:

Post a Comment